By Paulina Moskala | Bricksave

May 21, 2024

News > Blog Article > The importance of diversifying your investment …

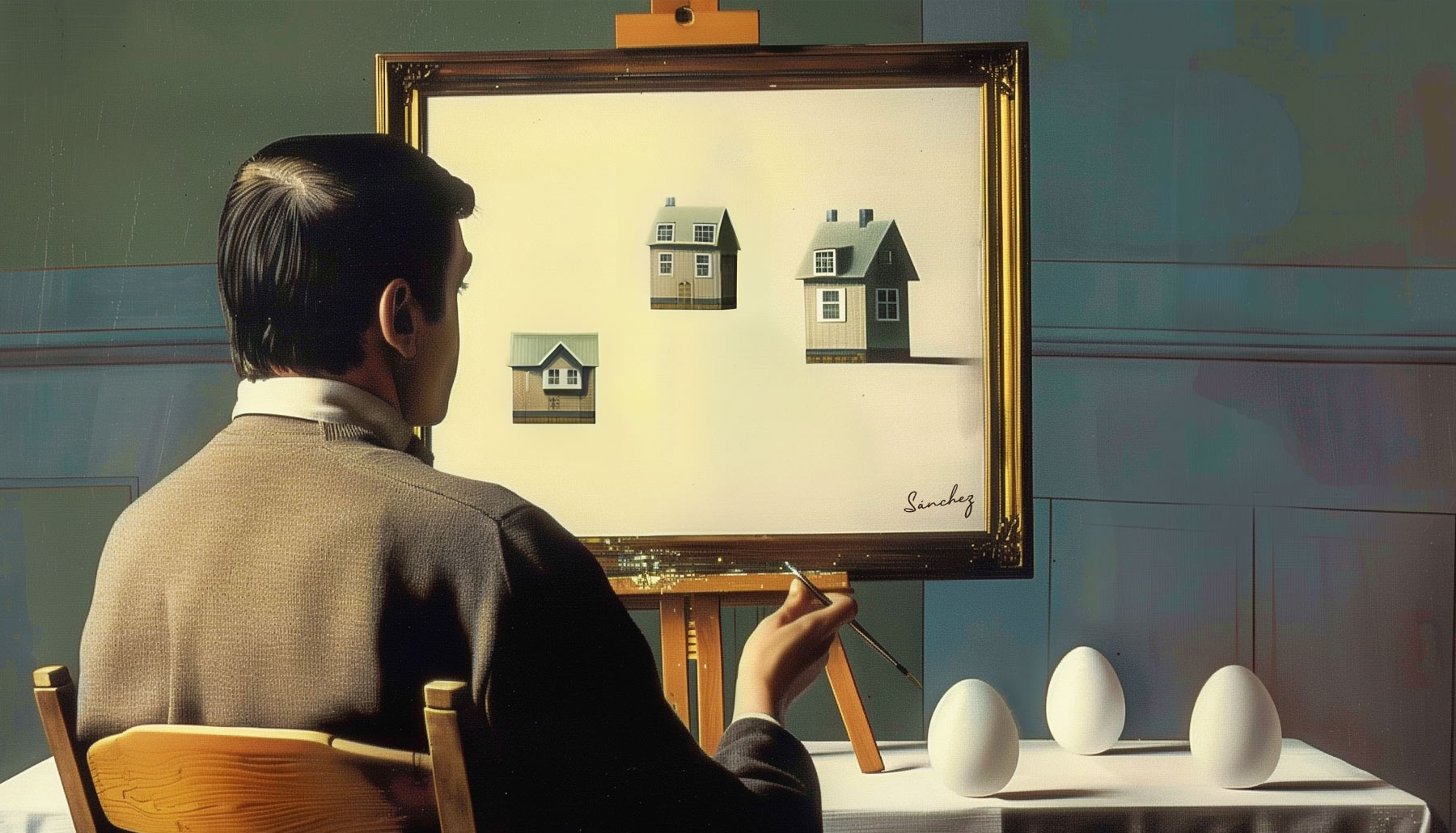

Investing in real estate is a powerful way to build wealth, but focusing solely on high-yield properties can sometimes lead to unnecessary risks. As Bricksave looks to expand our investment opportunities into new geographic locations across the U.S., it's essential to understand the importance of diversifying your investment portfolio. By broadening your investment horizons, you can ensure a well-balanced, stable, and potentially more lucrative portfolio in the long run.

Diversification is the practice of spreading your investments across various assets to reduce and manage risk. In real estate, this means investing in properties in different locations, types, and classes. The primary goal is to minimise the impact on your overall portfolio. of any unforeseen and unavoidable issues that might occur with a single investment. Diversifying your portfolio is crucial:

It’s essential to understand the different property classes and their implications on your investment strategy. Very briefly:

For a more detailed explanation, please refer to our property classes article.

For our investors, the key to successful diversification lies in carefully selecting properties across different classes and locations. Here are a few strategies to consider:

Allocate a portion of your investment to Class A and B properties in stable markets like Miami, San Antonio, and Philadelphia. Complement these with selective investments in Class C and D properties in emerging markets like Chicago and Detroit.

Spread your investments across different regions to avoid market-specific risks. This approach ensures that your portfolio isn't overly exposed to the economic conditions of a single area. There are several benefits to this strategy:

By spreading your investments geographically, you can protect your portfolio from localised economic downturns and capitalise on growth opportunities in multiple areas.

Regularly review and adjust your portfolio based on market conditions and performance. Rebalancing your investments can help maintain an optimal risk-return profile.

We understand that many of our investors seek the highest possible rental yields, often without fully understanding the associated risks. However, a well-balanced portfolio is the surest way to grow wealth and hedge against market fluctuations.

Our goal is to provide you with the best possible investment opportunities, backed by thorough research and market analysis. By considering slightly lower-yield investments in superior quality and less risky markets, you are taking a sensible step towards building as well as maintaining your wealth through real estate investment.

Start diversifying your portfolio today with Bricksave. Maximise returns and mitigate risks all at once.

Diversification is not just a buzzword; it's a fundamental principle of successful investing. By spreading your investments across various properties and locations, you can mitigate and manage risks, ensure consistent returns, and capitalise on market growth. As we launch new investment opportunities in cities like San Antonio and the American Midwest, we encourage you to embrace diversification for a more balanced and resilient portfolio.

Remember, the highest yields aren't always the best choice if they come with high risks. A diversified portfolio, with a mix of high-yield and stable investments, is the key to long-term wealth and financial security.

Investing carries risks, including loss of capital and illiquidity. Please read our Risk Warning before investing.