By Ruben Pueyo | Bricksave

December 05, 2024

News > Blog Article > How we identify the best investment …

At Bricksave, we understand that selecting the right real estate investment opportunities is crucial for achieving strong, long-term returns. We’ve developed a systematic, data-driven approach to identify the best markets and properties, ensuring our investors can make smart and profitable decisions. Let us guide you through our process.

Experience real estate made easy.

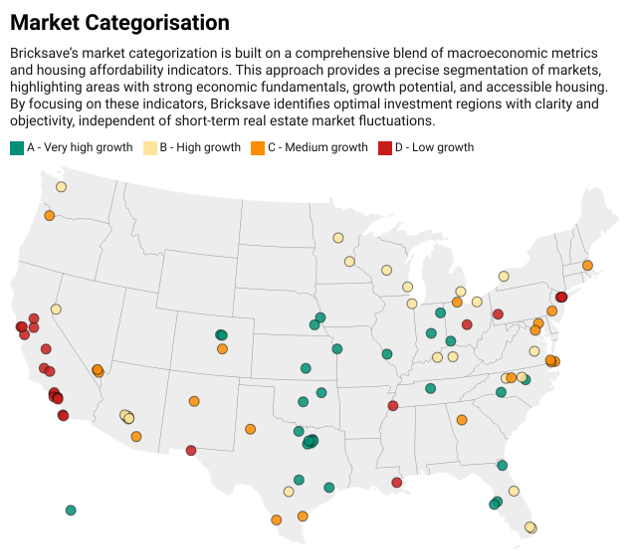

We begin by identifying the most promising markets worldwide. This is the first and most vital step in our process, where we evaluate regions based on their growth potential. We look at several key factors to assess whether a market is worth considering:

Economic growth:

We analyse the growth of the local economy by looking at GDP per capita, workforce expansion, and unemployment trends. We also consider rising household incomes, which are essential for sustaining demand in the housing market.

Demographics:

We focus on population growth, as an increasing population typically signals rising demand for housing. We also pay close attention to affordability, using metrics like price-to-income ratios and rent as a percentage of income to assess whether housing is accessible for most people.

Supply and demand:

We examine current construction activity in the market and look at forecasts for future supply. This helps us determine whether a market is likely to face oversupply or if demand will outpace the available housing.

By evaluating these factors, we can prioritise markets with the strongest growth potential, ensuring we focus on regions that offer the best opportunities for our investors.

Once we’ve identified promising markets, we dive deeper into the residential housing market. We use a detailed scoring system to assess how well each market is performing. This enables us to compare different markets and pinpoint those offering the best investment opportunities. Key metrics we assess include:

Market demand:

We look at sales velocity (how quickly homes are selling) and sales-to-list ratios to understand how competitive the market is. High demand is usually a good sign that properties will appreciate in value.

Supply and pricing trends:

We examine changes in house prices and rental vacancy rates. This helps us predict whether property prices will continue to rise or if the market is nearing a peak.

Rental market health:

Gross yield analysis helps us determine if the potential rental income justifies the investment. We also evaluate rental growth patterns to ensure the market will continue to offer good returns.

To make these comparisons easy, we use a Z-score methodology to standardise the data. This converts all the raw information into a scale from 0 to 100, so we can clearly rank and compare different market opportunities.

We don’t stop at identifying markets with strong growth potential. The next step is to balance these growth factors with liquidity (how easy it is to buy and sell property) and yield (the potential returns on investment).

Liquidity:

Markets with high liquidity are essential because they offer flexibility for future exits. A market with good liquidity makes it easier to sell properties when needed, ensuring our investors can move as quickly as possible if their goals or circumstances change.

Yield:

We focus on markets that offer attractive gross yields relative to the risk involved. Yield optimisation is a key priority, as we want to ensure our investments not only grow but also provide strong returns compared to their risk level.

By considering both liquidity and yield, we ensure that our investment choices are not only stable and high-performing but also flexible and profitable over the long term.

Once we’ve identified the top markets based on their growth potential, liquidity, and yield, we move to the final phase: narrowing down to specific neighbourhoods or zip codes. This step involves using our proprietary algorithm, which analyses millions of data points and evaluates each property against over 275 different factors. These include:

Demographics:

We examine population growth, workforce distribution, crime rates, and the overall socioeconomic profile of the area. We also look at the types of industries driving employment in the area and how these factors influence housing demand.

Housing characteristics:

We assess ownership rates, vacancy rates, property age, and rent levels. These metrics help us understand the health of the housing market and predict how property values may change in the near future.

Community factors:

The quality of schools, crime rates, and other community factors like educational attainment play a big role in determining the long-term potential of a neighbourhood. We also look at tax rates and mortgage levels to get a complete picture of the area’s appeal.

This localised approach ensures that every property we select for investment is located in an area where macroeconomic trends and local factors align to create the best possible return on investment.

Our multi-phase process ensures that we are selecting the best possible investment opportunities for our clients. By combining broad market analysis with detailed local insights, we are able to:

Focus on high-growth markets: We prioritise regions that have strong economic and demographic fundamentals, ensuring we invest in areas that are primed for growth.

Optimise returns: By selecting properties in markets with strong rental demand, low vacancy rates, and high potential for price appreciation, we ensure our investments generate consistent and attractive returns.

Mitigate risks: Our focus on liquidity, yield, and local data helps us minimise risks, ensuring that our investments remain resilient, even in fluctuating market conditions.

Start building your future with the best real estate investments. Invest today, from USD 1000.

At Bricksave, our investment strategy is built on a solid foundation of data and analysis. By combining global market assessments with detailed, neighbourhood-level insights, we are able to identify high-potential investment opportunities that align with both short-term and long-term goals.

Real estate investment doesn’t have to be complicated, nor does it have to be risky. With our clear, systematic approach, we make it easier for you to invest in properties with confidence. Ready to explore the best investment opportunities? Let us help you navigate the world of global real estate and start building your investment portfolio today.

Investing carries risks, including loss of capital and illiquidity. Please read our Risk Warning before investing.